Index Investing

Which US Market Index to Follow

Submitted by Van Beek on June 29, 2011 - 04:39

Following just a single US Market Index is not enough.

To know the overall direction of the US stock market and to invest your savings wisely, you want to follow a US market index. However, there are a few different US market indices. How do you know which US market index to follow?

Here we answer that question for you, taking into account what you want to do with the answer.

When you want to know the long-term direction of the US stock market, we suggest that you do not focus on just one US market index.

Long-term US Trend Direction

At Stock Trend Investing, we follow the four most important indices.

Two of these four are indices for the two major stock exchanges in the US:

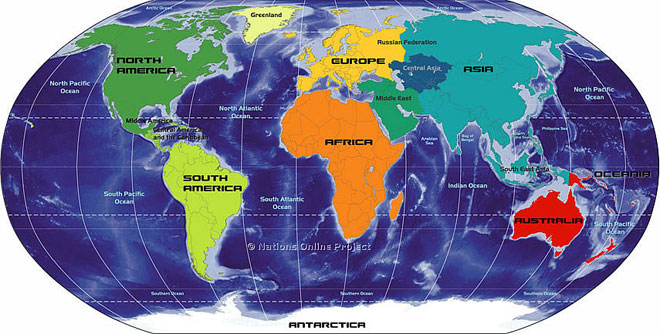

Rebalancing Your Portfolio of Geographical Index Funds

Submitted by Van Beek on April 21, 2011 - 13:10

A geographical diversified portfolio of index funds offers the opportunity to rebalance

One reason for diversifying your stock investments geographically around the world is the portfolio rebalancing opportunity.

Here are two quotes from Index Investing for Dummies regarding portfolio rebalancing:

“The best way to raise cash (should you need it) is not through dividends but through regular portfolio rebalancing.”

The Small Cap Lesson from Index Investing for Dummies

Submitted by Van Beek on April 20, 2011 - 10:18

Index Investing for Dummies Review

Submitted by Van Beek on April 19, 2011 - 11:12

Index Investing for Dummies is a very useful book about investing, both for beginners as for investors with more experience. It explains and provides the tools for a simple, straightforward and effective approach for long-term investing.

In summary, you can say that it advocates buy and hold investing with low cost ETFs and Mutual Funds that follow well defined stock market indices.

Stocks Index Investing Funds for Dummies

Submitted by Van Beek on April 16, 2011 - 12:28This page shows a number of stocks funds that are listed as well in the book Index Investing for Dummies and that are of interest for Trend Investors. This book lists a range of low cost Index ETFs and Mutual Funds that follow indices that are worth following. Index Investing for Dummies lists many more funds than the ones below.

Three Investing for Beginners Lessons: Start with Index Funds, not Stocks

Submitted by Van Beek on February 23, 2011 - 17:14

The biggest loss I ever made on a single investment was the investment in the stock of a company that I knew best. This is a great lesson for beginners who want to start investing. It was in 2000 and I bought shares in the company that I was working for. I know that company inside out. I know its industry. I know the competitors. It was and is the dominant global market leader in its market. And still I lost more than 60% of my investments in that company.

BSE, Sensex and Nifty and Index Funds for the Indian Market

Submitted by Van Beek on September 6, 2010 - 10:58When one of our readers asked for a chart of the Nifty, we wondered how the Sensex and Nifty correlate. Sensex is the index of the BSE (Bombay/Mumbai Stock Exchange) and Nifty is the index of the NSE, the National Stock Exchange of India.

See the Yahoo Answers page here for more background on the Sensex, BSE, Nifty and NSE.

Which stock market indices declined most during May?

Submitted by Van Beek on June 1, 2010 - 08:45How much did the different stock market indices actually decline during May? And which markets declined more, the US markets, the Asian markets or the European markets?

At Stock Trend Investing, we made a quick overview for you to get an answer to these questions. Some of the observations are surprising.

Would you invest at this moment in FTSE index funds?

Submitted by Van Beek on May 26, 2010 - 05:55Markets are in turmoil. But maybe you have some savings that you want to invest. When you are living in the UK you may favour some FTSE index funds for example. However, is it now a good time to invest these savings?

Last week I got a question from a reader on what I thought about investing in the FTSE at this moment. I’ll come back on that later in this blog post. Let me first comment a little on last week. That was a week full of turmoil; not only in the financial markets but also in Bangkok, where I am living at this moment. Because of the unrest in Bangkok and the forced closing of the schools, we decided to go for a week to the beach on Koh Samui; great decision and great week.

10 must read articles if you do not invest in index funds yet

Submitted by Van Beek on May 6, 2010 - 10:58Do you still doubt if you should invest in index funds or are you not really aware of what index funds are? At Stock Trend Investing, we have selected 10 articles that will give you quickly an overview of what is written and what one thinks about index funds.

From each article, we have taken a short quote, but we encourage you to read the original articles at the renowned sites as CBS MoneyWatch, Forbes, and NY Times etcetera. The titles below link to the original articles.