- End of 12 Years of Monthly Stock Market Trend Updates

- Alternative Services for Trend Signals

- S&P 500 Trend Signal Email Alert

- Two Favorite Economics and Investment Newsletters

- Get Email Alert When S&P500 Trend Turns Down

- Currencies Impact Stock Market Profits

- Trend Investing Whip-Saw Reality

- Not Trend Following But Trend Investing

- How to Invest My Savings Safely for Good Long-Term Returns?

- Does Trend Trading the ASX Work?

Van Beek's blog

End of 12 Years of Monthly Stock Market Trend Updates

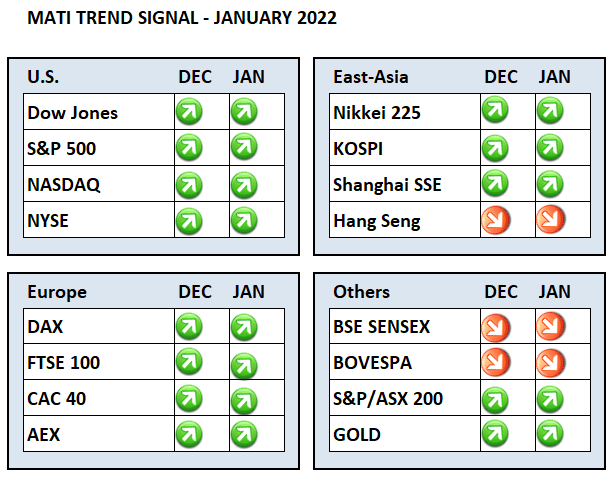

January 2, 2022 - 23:16 — Van BeekAfter 12 years of providing monthly updates to our subscribers about the long-term trend status for various stock market indices and gold, we provided on January 2nd, 2022 our last and final update.

You can read it here, and view the history of updates.

And then here below is a an example of the long-term trend signal dashboard that was updated on a monthly basis.

Alternative Services for Trend Signals

January 2, 2022 - 22:29 — Van BeekAt Stock Trend Investing we realized that over time alternative services have become available that are just as good or even more elaborate than what we are providing.

Thus we announced mid 2021 to our subscribers that by the end of 2021will be stopping our services to subscribers (note that we will keep updating the signals for ourselves for some of the markets since they are still just as valid as before).

We will as it looks lik for now not offering any comparable services.

Therefore, here are some really good alternative services that I like (but note that I have no affiliation with them at all or do not know these people personally).

S&P 500 Trend Signal Email Alert

June 2, 2019 - 09:38 — Van BeekFollowing the requests from many of our visitors, we are launching now the S&P 500 Trend Signal Email Alert.

If you are just interested in getting an email alert when the long-term trend of the S&P 500 index changes direction, click here.

When you sign up for this email alert service, you will get immediately an email from us when the MATI signal indicates a shift in the long-term trend direction.

This may happen only once or twice in the few years. We are talking long-term trends here.